Have you ever wondered how service organizations ensure that every minute of work adds to the top and bottom line?

It is by tracking billability. Measuring billable hours enables service-based companies to gauge how effectively the workforce delivers client work. Therefore, this key metric is vital in maximizing employee output while improving the company’s financial health.

Besides, tracking employee billability ensures accurate client billing, which helps prevent revenue loss, improve cash flow, and boost ROI. As a result, services firms are constantly striving to maximize their billability to foster long-term financial stability.

In this blog, we will discuss the fundamentals of billability, types, significance, and the steps to maximize it.

Let’s begin.

What is Billability?

Billability is a critical metric representing the amount of work an employee does that can be directly billed to clients. It includes time spent on revenue-generating activities such as project work, client meetings, research, etc., compared to non-billable work such as BAU and administrative tasks.

Thus, tracking billable hours helps service-oriented organizations analyze the value offered to clients and ensure they are compensated appropriately. More importantly, it allows them to identify and address revenue leakage and protect profit margins. Additionally, regular tracking enables firms to improve revenue recognition and forecasting.

Now, let us understand its various types.

Types of Billability

Billability focuses on the potential of a role, individual, or task to generate revenue. Here are the three types:

Role Billability

Role billability measures the billable potential of a specific job role within an organization. Some roles, such as consultants or developers, have high billability as most of their work is client-facing and chargeable. Others, like HR or internal IT support, may have lower billability as they focus on internal functions. By understanding role billability, businesses can structure their workforce to maximize revenue-generating activities.

Task Billability

Task billability focuses on individual tasks and determines whether they are chargeable to a client. Some tasks, such as project deliverables or consulting hours, are fully billable, while others, like internal meetings or administrative work, are non-billable. Therefore, tracking task billability helps strike the right balance between the two and ensures more time is spent on client-focused work.

Individual Billability

Individual billability assesses the billable hours of a specific employee based on their assigned work. It is typically measured as a percentage of total working hours. Moreover, it helps organizations evaluate productivity and profitability at an individual level. High individual billability indicates strong revenue contribution, while low billability may signal inefficiencies, skill mismatches, or a need for better workload distribution.

Now that you know the different types, let us move on to the major differences between billability and utilization.

Billability vs. Utilization: Key Differences

Though billability and billable utilization are often used interchangeably, they capture different aspects of work performance. The table below explains the difference between the two:

| Aspect | Billability | Utilization |

|---|---|---|

| Definition | Percentage of total work that can be billed to the client. | Percentage of total time spent on billable work compared to non-billable activities. |

| Focus | Determines whether a role, individual, or task is revenue-generating. | Evaluates how efficiently time is allocated between billable and non-billable tasks. |

| Scope | Specific to client-facing work that can be invoiced. | Encompasses both billable and non-billable work, such as internal meetings, training, or admin tasks. |

| Impact on Revenue | Directly influences revenue generation by ensuring work is chargeable to clients. | Helps optimize employee productivity to maximize billable hours. |

| Example | A consultant’s work on a client project is billable, while a resource manager’s scheduling tasks are not. | If a consultant has 40 available hours and spends 30 on billable tasks, their utilization rate is 75%. |

Read More: Billable Hours: Definition, Benefits, and Key Strategies to Maximize Them

Let us understand its benefits in a business setting.

Importance of Billability

Monitoring billable hours is crucial for any business because it gives an idea of its profitability. Here are a few benefits in detail:

Optimizes Workforce Productivity

Billability enhances productivity by ensuring employees stay accountable for their daily tasks. When individuals know their task is tracked, they prioritize client-centric work over less critical activities. Moreover, comparing billable vs. non-billable hours enables managers to adjust resource schedules to ensure maximum productivity.

Improves Organizational Efficiency

Monitoring the billable work enables managers to identify bottlenecks where mundane and BAU activities consume excessive time. This insight allows them to implement better work management practices and leverage advanced tools to automate work, ultimately enhancing operational efficiency.

Read More: Operational Efficiency: What is it, and How to Maximize & Boost ROI?

Enhances Revenue Generation

Accurately tracking billability ensures that every revenue activity is captured and invoiced to the client, contributing to the organization’s income stream. Moreover, a higher billability rate indicates the resources spend more time on client-facing tasks. This boosts profitability by maximizing productive work and lowers the overhead costs associated with non-billable activities, further enhancing the bottom line.

Boosts Client Satisfaction

Businesses can provide clients with accurate invoices by measuring employees’ hours on billable activities. Detailed billing and accurate time-tracking give project stakeholders clear insights into progress and costs, fostering trust. Moreover, it leads to improved quality of work and more efficient project delivery, which further contributes to long-lasting client relationships.

Read More: Who are Project Stakeholders? 7 Effective Ways to Manage Them

Now that we know the benefits of billable hours in a firm, let us move on to the formula to calculate it.

How to Calculate Billability?

To measure billability, we use this formula:

| (Number of Hours Resource is Billable / Number of Hours Resource is Available) X 100% |

|---|

Let us now see an example to understand the formula better:

A construction firm assigns one of its engineers to a residential township project, and the project is expected to be completed in 6 months and approximately 850 billable hours. The total hours available (capacity) are based on a 40-hour work week across 22 weeks of the year (minus holidays). The total hours available is hence 880 hours (40 hours/week × 22 weeks).

Let’s summarize the given details –

- One engineer assigned to a project

- Project duration = 6 months (≈ 22 weeks)

- Workweek = 40 hours

- Total available hours (capacity) = 40 hours/week × 22 weeks = 880 hours

- Total billable hours expected = 820 hours

Now, applying the formula:

| (820 ÷ 880) X 100% = 93.18% |

|---|

Therefore, the billable time for this engineer is approximately 93%.

Let us see a few strategies to boost billables hours in a firm.

Read More: What is a Construction Management Plan? A Complete Guide

How to Boost Billability in a Firm?

Boosting billable hours in a firm is the key to making it profitable. Let us see how to boost it with these strategies:

Set Realistic Billability Goals

The first step to boost billable hours involves establishing achievable targets while ensuring consultants are not overwhelmed. Moreover, these targets must align with overall revenue and business goals. For this, managers can set resource utilization benchmarks based on their roles and types.

For example, different industries set separate billability goals for different resource types, i.e., permanent or contingent workforce. Usually, contingent employees have 100% billable goals, whereas permanent staff have 70-80% targets. This distinction allows companies to maximize billable hours while keeping workloads in check.

Read More: What is Resource Utilization? A Complete Guide to Improve Business Efficiency

Automate Repetitive Mundane Tasks

Organizations can leverage automation tools to handle repetitive, time-consuming tasks like data entry, invoicing, and resource scheduling. This frees up professionals from mundane work and enables them to prioritize high-priority, client-facing tasks, improving productivity.

However, not all tasks can be automated, as some need human inference and expertise. For example, while meetings require real-time discussions, excessive meetings can reduce billable hours. In such cases, managers can optimize meeting schedules, allowing more focus on billable work.

Establish and Track Billability KPIs

Establishing key performance indicators makes it easy to measure billable hours and identify issues early. Managers can effectively recognize top performers and address inefficiencies by evaluating KPIs such as billable hours, employee productivity rates, average billable hours per employee, and task completion rates.

For example, an audit and accounting firm can set a KPI of 80% billable hours per month. If an employee is not able to achieve this target, it indicates that additional training or workload adjustment is required. Thus, by proactively monitoring the metrics, managers can take necessary actions.

Read More: Employee Productivity: What is it & Why Does it Matter?

Balance Billable vs. Non-Billable Hours

Striking the right balance between billable and non-billable hours is crucial to boost profitability. To achieve this, managers can first establish a clear distinction between billable works, such as client projects, and non-billable activities. This builds shared understanding among the employees and reduces the chances of disputes.

Moreover, while some non-billable time, such as training or strategic planning, is necessary, excessive time spent on these activities can impact revenue generation. In such cases, managers can mobilize resources from non-billable to billable activities to maintain focus on high-value, revenue-generating work.

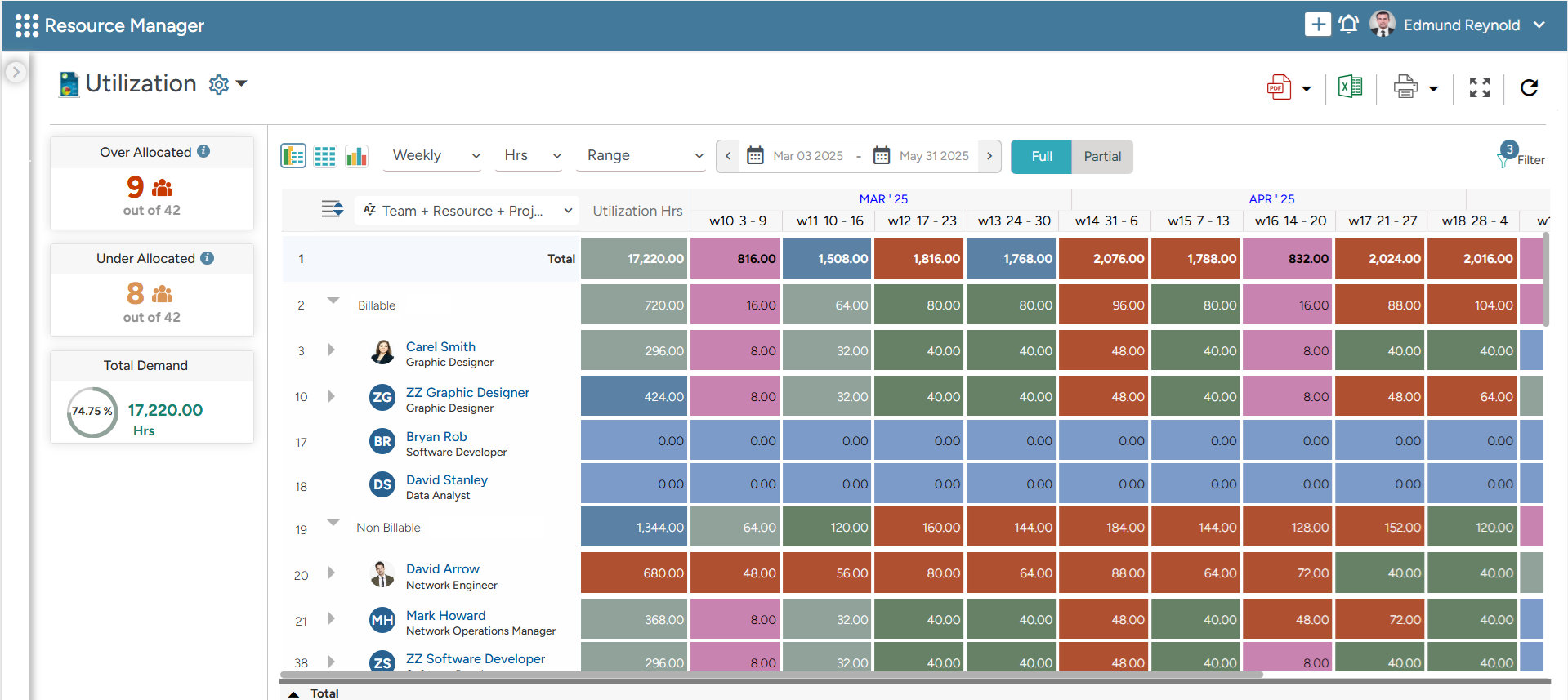

SAVIOM’s Color-Coded Heatmap provides insights into teams’ billable vs. non-billable utilization, enabling you to optimize workload and boost billability.

Minimize Employee Bench Time

Minimizing bench time reduces non-billable hours and boosts profitability. For this, managers need to adapt proactive capacity planning strategies. Through this, they can foresee pipeline project requirements and people on the bench and deploy resources to project vacancies accordingly.

For example, software developers might end up on the bench in an IT consulting firm due to project transitions. Here, managers can assess the project pipeline and assign the benched developers to appropriate vacancies to minimize idle time. This improves their billability and ensures steady revenue flow.

Read More: What is Resource Capacity Planning? An Ultimate Guide for Every Project Manager

Provide Multi-Skill Building Opportunities

Upskilling and training opportunities help build a skilled talent pool. By encouraging multi-skill development through cross-training, job shadowing, and project-based learning, employees can take on diverse roles beyond their core competencies.

This flexibility enables resources to contribute to multi-faceted projects, reducing dependency on specific individuals and keeping billable hours high. Moreover, a multi-skilled workforce allows firms to capture market opportunities and boost long-term profitability.

Implement Robust Time Tracking Tool

Implementing a robust time-tracking tool helps service businesses monitor how resources spend their time. Managers can identify inefficiencies by comparing actual hours spent on tasks against planned time, and accordingly, they can take corrective measures to maximize productivity.

Moreover, the time tracking tools also ensure that every minute of client work is accurately captured, preventing billing discrepancies and improving transparency. With precise data at their behest, service firms can make informed decisions to optimize resource allocation and maximize time on client-focused tasks.

Read More: What is Time Management? 9 Effective Strategies to Master It

Now, let us see how resource management software helps with optimizing billability.

How Does Resource Management Software Help Track and Optimize Billability?

SAVIOM’s 5th Gen resource management software helps managers to check and maximize billable hours, thereby increasing the profit of the company. Let’s explore how it works:

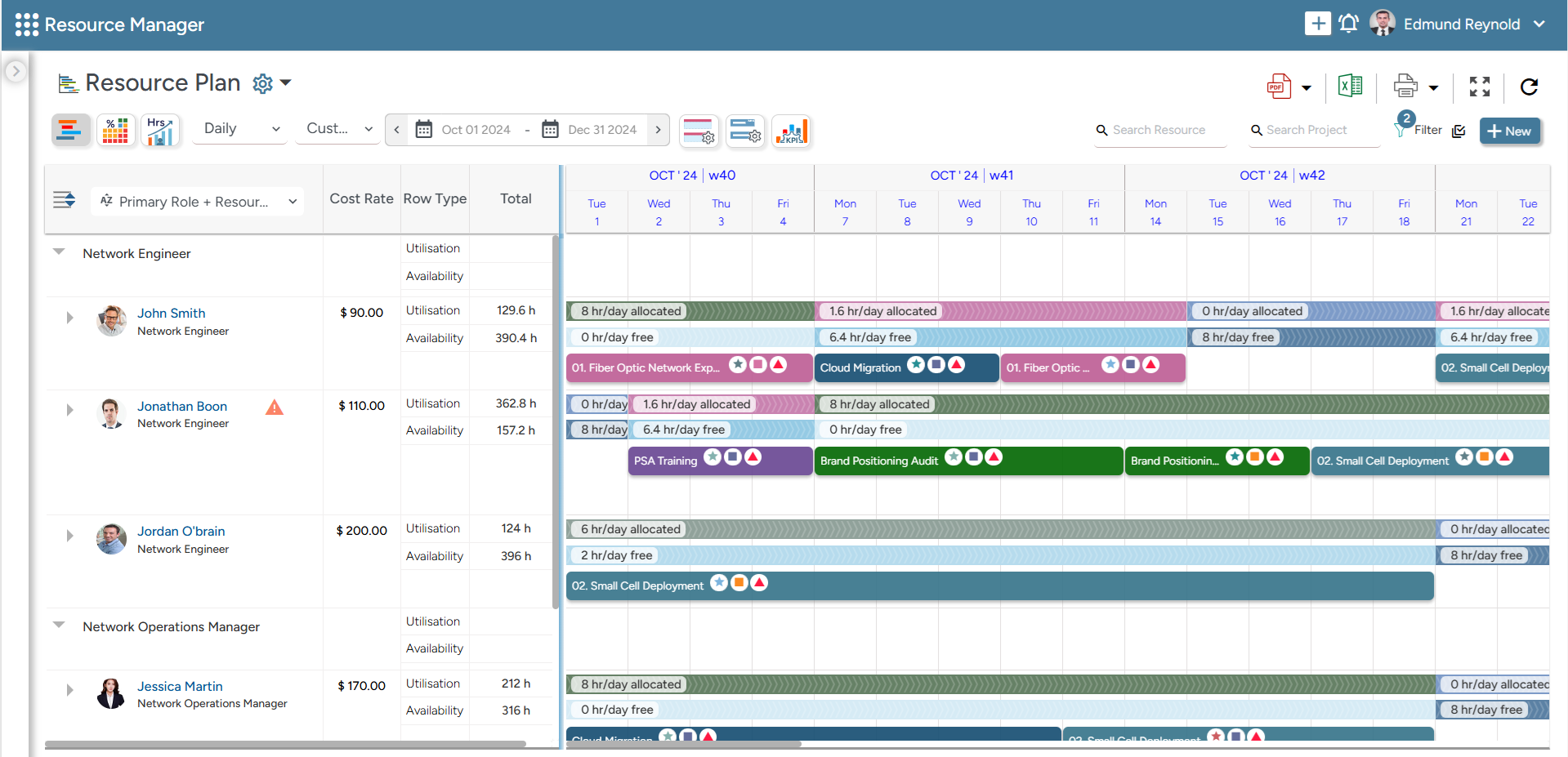

- The all-in-one resource planner provides 360-degree visibility into consultants’ skills, experience, and availability across the enterprise.

SAVIOM’s All-in-One Resource Planner provides 360-degree visibility, helping you allocate suitable resources to the right job.

- The multi-dimensional resource scheduler allows managers to mobilize consultants from non-billable to billable work with an easy drag-and-drop function.

- With advanced forecasting and capacity planning features, firms can predict project demand, identify capacity vs. demand gaps, and take measures to ensure profitability.

- The software provides forecast vs. actual reports, allowing firms to spot variances in billable hours and take corrective actions.

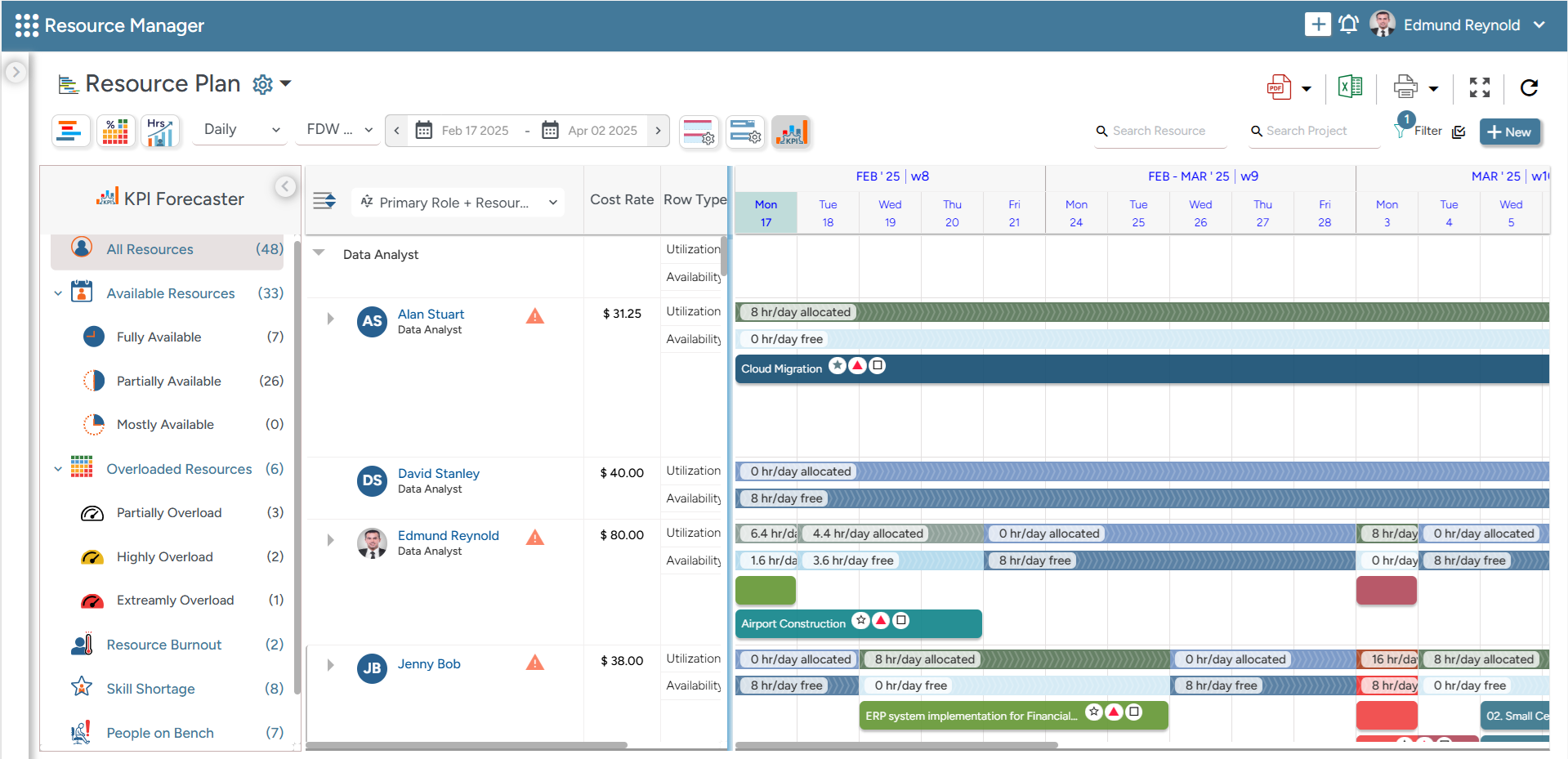

- The KPI forecaster provides detailed insights into metrics such as skill gaps, utilization, and project vacancies, enabling managers to optimize workload distribution and maximize billability.

SAVIOM’s KPI Forecaster provides quick insights into metrics such as skill shortages, under/overutilization, project vacancies, and people on the bench.

- Lastly, built-in timesheets capture detailed work hours, allowing managers to analyze productivity trends and make informed decisions to enhance billable hours.

Read More: How Can You Make Data-Driven Decisions with Resource Management Software?

Key Takeaways: Additional Tips to Consider

As we now know, tracking billability is the key to understanding a company’s profitability and is vital for its long-term success. Apart from what we read, here are a few additional tips and takeaways:

- Establish clear guidelines on what qualifies as billable work to ensure accurate invoicing and prevent conflicts.

- Regularly analyze billability trends or fluctuations in billable hours to understand the inefficiencies and areas for improvement.

- Distribute administrative and internal work fairly among team members to avoid burdening a few while ensuring essential activities are managed efficiently.

- Perform routine audits to assess how employees spend their work hours and identify areas of improvement.

- Minimize distractions like emails, excessive meetings, and unnecessary multitasking to ensure employees remain focused on revenue-generating tasks.

Now that we know the importance of billability, how will you ensure that your resources are assigned to client-centric work?

The Glossary

Read More: Glossary of Resource Workforce Planning, Scheduling and Management